Audits of the rich cratered at the start of the pandemic. That's about to change.

Armed with an extra $80 billion in funding for the next decade, the Internal Revenue Service is using the bulk of its war chest to scrutinize taxpayers who make more than $400,000 a year, focusing on high-net-worth individuals, corporations, and partnerships.

Audits of the rich dropped sharply in 2020

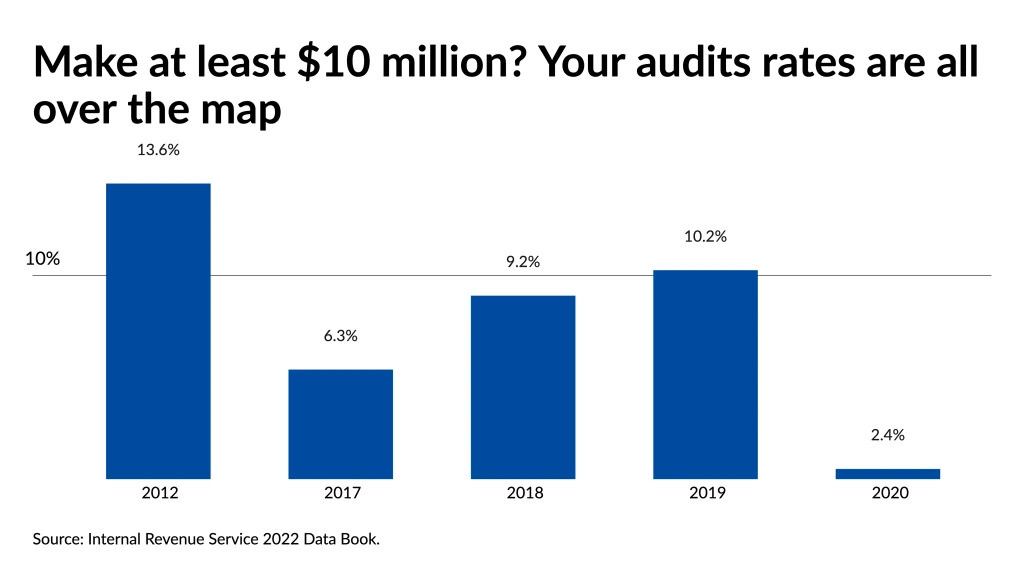

That means heightened inspection of the highest earners, whose chances of being audited have swung wildly over the past four years, including a steep annual drop of 75% in 2020, the first year of the pandemic.

IRS Commissioner Daniel Werfel said last month that the agency will audit taxpayers reporting income of less than $400,000 at the same rate it did in 2018, when returns were filed for 2017, before the Trump administration undertook a giant overhaul of the tax code that slashed individual rates to historic lows beginning in 2018.

Officials have made no similar statements about using a given historical rate for higher earners. That suggests such taxpayers will bear the brunt of the new scrutiny.

Reducing the tax gap

The nation's tax collector traditionally audits federal returns at different rates, based on how much income is reported. It's aiming to reduce what's known as the tax gap, or the difference between taxes due and taxes paid. The Treasury Department estimates the shortfall, which is fueled by tax evaders, at around $600 billion annually, the equivalent of $7 trillion of lost tax revenue over the next decade. Individual rates are due to rise come 2026, which may account for the outsize lost tax revenue figure.

The IRS's additional $80 billion, of which $45.6 billion will go to enforcement, is expected to increase federal revenue by more than $180 billion in the coming decade, a smaller slice of the tax gap. The rest of the new funding will go to improve taxpayer services — such as having an IRS staffer actually pick up the phone — operations support and modernization of the agency's antiquated technology, some of which dates back 60 years to the Kennedy administration.

Wild swings in audit rates for the wealthy

Overall audit rates have been declining for more than a decade. But in recent years, there have been stark year-to-year shifts in rates for higher earners.

In 2012, the IRS scrutinized 136 of every 1,000 taxpayers making at least $10 million, or 13.6% according to the agency's most recent data book.

By 2017, the rate had plunged to 6.3% of those making at least $10 million.

But the next year, the rate increased, with 9.2% falling under the microscope in 2018.

By 2019, the rate for those making at least $10 million went to 10.2%.

Then, in 2020, it plummeted to 2.4%.

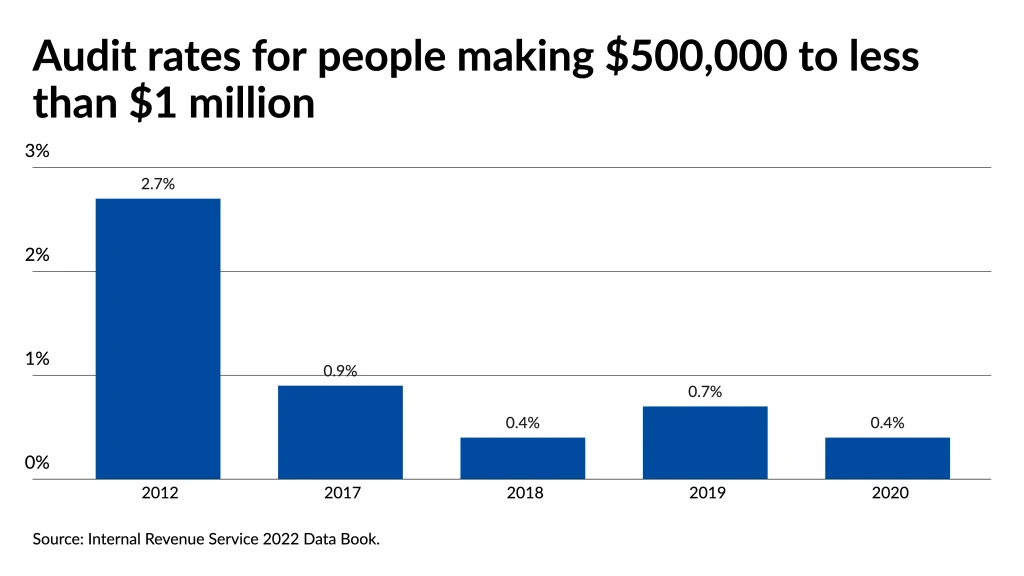

Changes in audit rates for those making $500,000 but less than $1 million have also swung over the years but haven't had the steep drop-off seen for $10 million-plus earners.

When it announced its strategic plan for eight fiscal years through 2031, the agency noted it has roughly 80,000 employees today — down 20% from the 95,300 it had in 2010 — thanks to budget cuts. Meanwhile, the U.S. population, comprising both taxpayers and individuals in tax-paying households, has grown by 7%.

The number of affluent Americans has grown

Mostly, it's the number of well-off and very rich Americans that has surged, thanks largely to the recent bull stock market. From 2020 to 2021 alone, the number of U.S. households with a net worth between $1 million and $5 million, not including the value of the primary residence, rose 8.1% to 11.6 million, according to Spectrem Group. The number of ultrarich households with at least $25 million surged 17.8% to 252,000 over that period.

Scott Bishop, the executive director of wealth solutions at Avidian Wealth Management in Houston, said the agency faced a major hurdle in putting its war chest to work: a nationwide shortage of accountants, in particular those who can pore over complex returns involving partnerships.

A nationwide shortage of quality tax accountants

"So the real question is, are they going to find quality people to know what they're doing?" asked Bishop, who is both a certified financial planner and a certified public accountant.

Still, two things seem likely, he said.

First, the agency will find it easy to root out people who owe taxes on their digital payments. A law that went into effect this year requires cash apps and online marketplaces like PayPal and eBay to send tax documents to millions of Americans if they receive $600 or more in a calendar year. The previous threshold was $20,000 earned through at least 200 transactions. The IRS is worried about the rise of the gig economy and payments that go unreported by people whose W-2 employment wages form isn't filed to the agency.

Second, Bishop said, the IRS was likely to focus on banned tax dodges known as listed transactions. The agency has a laundry list of abusive tax shelters that include syndicated conservation easements, employee stock option plans in private companies, accelerated deductions for contributions to 401(k) retirement plans, and abusive Roth IRA transactions. In the latter, the IRS is looking at transactions in which a taxpayer contributes property or shares in a private company to a tax-free Roth for less than their fair market value, avoiding tax bills.

Said Bishop: "They're going to be looking at things that aren't even in a gray area anymore."

We're here to help you keep it all above board.

Time will tell if the IRS will indeed focus on auditing the ultrarich. Just don't expect them to take their eye off of the little guy at the same time. Not gonna happen. So, your best bet, whatever income level you're at, is to always pay your taxes and stay compliant with the IRS. And remember, if you find yourself with a tax problem of any kind, don't hesitate to reach out to us – we know all the ins and outs – and we're here to help.

You can contact me by one of the methods below in the blue box, or email me at Larry@TaxProblemSolver.com and we can review your specific issues and solve them. You can also click here to book a free consultation.

Would You Like to Find Out What Your

Next Best Steps Should Be?

Choose one of the 3 FREE contact methods that is easiest for you.

Click the calendar button below to view our appointment calendar, and choose a day & time, and we’ll call you then.

We look forward to your free consult!

Click the phone button below to either "click to call" or direct dial a number to speak with us right now.

We look forward to speaking with you!

9-Secrets You Need to Know

When the IRS is after you, you need to be informed. What you say to the IRS can be used against you.

Get My 9 Secrets email series now. I'll also add you to my newsletter.